B2B Invoicing: 6 Best Practises for B2B Ecommerce Businesses

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

While 80% of B2B (business-to-business) payments in 2004 were still made using paper checks, that percentage has dramatically decreased, hitting only 42% in 2023. In addition, a recent report revealed that the global electronic invoicing market size reached $13.5 billion in 2023 and is projected to grow by an annual rate of 17.7%, reaching $60.9 billion by 2032.

B2B invoicing, the process of billing for goods or services exchanged between businesses, is a crucial element of creating that modern B2B experience. In this article, we’ll dive into some best practises for B2B invoicing, explore common challenges, and provide tips on selecting the right ecommerce tools to help you streamline your operations and stay ahead of the competition.

Best practises for B2B ecommerce invoicing

Ninety-five percent of B2B buyers want the option for invoice payments when shopping online, making it the most popular payment method in the B2B sector. However, simply offering this payment method doesn’t guarantee success. Let’s explore a few best practises that will streamline your invoicing process and keep your clients satisfied with the customer experience.

Send invoices ahead of time.

As a B2B company, it is crucial that you’re getting paid on time. But getting paid on time means that you need to send invoices ahead of time.

Rather than waiting several days or weeks to deliver an invoice to a client, make sure that you’re sending them as soon as possible after goods or services have been delivered. Delivering invoices promptly not only provides your clients ample time to process payments, but it also ensures that your business always has a steady cash flow.

Ensure transparent communication.

Your job isn’t complete when you send a B2B invoice. Before and after sending an invoice, make sure you’re keeping open lines of communication with your clients. This can look like frequent payment reminders via email or phone after delivering the invoice, or even a quick phone call to make sure they’re satisfied with their service.

Offer multiple payment options.

Nowadays, B2C customers have the freedom to choose between numerous payment methods when purchasing online. Think Buy Now, Pay Later (BNPL), digital wallets, and even cryptocurrency. And now, B2B buyers are expecting the same flexibility.

The more payment options you provide, the more likely it is that your B2B customers will be satisfied with their experience — and complete payments on time. Here’s a list of some of the most popular types of online payment methods for B2B buyers.

Credit cards

Debit cards

Traditional trade credit

Purchase order (PO)

Paper checks

Cash on delivery

Digital wallets

Bank-to-bank wire transfers, including ACH (Automated Clearing House)

Same-day ACH

ePayable with virtual cards

Provide secure payment methods.

In addition to offering multiple payment options, you’ll also need to ensure that these payment methods are secure — meaning they protect sensitive information in your B2B transactions. Implement secure options like encrypted credit card processing, ACH transfers, and digital payment platforms such as PayPal or Apple Pay to ensure that clients' financial data is safeguarded.

Charge late payment penalties.

If customers don’t complete payments on time, it could result in higher interest rates or poor credit scores for your business. To minimise outstanding invoices, it could be beneficial to incentive customers with late fees. By clearly outlining these penalties in your payment terms, you can create a sense of urgency for timely payments and discourage delays. This practise not only helps maintain a steady cash flow but also fosters a more reliable and respectful business relationship.

Address disputes promptly.

Sometime along the way, it’s likely that a customer will dispute a payment. However, this is an opportunity for your business to demonstrate your ability to resolve issues efficiently and your commitment to customer satisfaction.

Before these situations arise, make sure that you establish clear communication channels and have a structured process for handling disputes, so that you can resolve issues efficiently, prevent escalation, and build trust with your clients.

Challenges with B2B ecommerce invoicing

Navigating the complexities of B2B ecommerce invoicing can be a daunting task for businesses. From handling high volume B2B orders to ensuring timely customer support, the challenges can be multifaceted.

Let’s explore five of the most common invoicing challenges faced by B2B companies and how you can combat them.

Handling high invoice volumes.

As a B2B business, you’re likely juggling numerous customer accounts, high order volumes, and a large number of invoices. Thus, without the necessary systems to properly automate and streamline workflows, your business can face potential delays, errors, and increased administrative burdens. However, automated invoicing solutions can help alleviate these issues by ensuring timely and accurate invoice generation, tracking, and reconciliation.

Achieving integration with other systems.

Just like your CRM, your ERP, and your accounting software, your invoicing solution is an integral part of your back-end, and thus needs to be able to integrate seamlessly with the rest of your ecommerce platform. However, the integration process can be complex, often requiring custom solutions and ongoing maintenance.

But by investing in a scalable, flexible integration solution, your business will be able to synchronise data across systems, allowing for real-time updates on transactions, orders, and inventory levels.

Ensuring timely customer support.

Due to a high volume of customer enquiries and the complexity of B2B purchases, providing prompt customer support can be easier said than done. Luckily, the rise of AI-driven chatbots has offered a solution to business woes. By leveraging AI, implementing dedicated support channels, and maintaining a knowledgeable support team, your business can significantly enhance response times and increase customer satisfaction.

Accommodating custom invoice requirements.

In a B2C transaction, a customer makes an online purchase for a set price, and the business provides them with a simple receipt at checkout, which includes the total amount paid and basic customer details. B2B sales, however, often require complex specifications, such as unique purchase order numbers, specific tax codes, and detailed payment terms. Since each client has distinct needs, failing to meet these can lead to delays, disputes, and even lost business.

To navigate this, businesses can implement flexible invoicing systems that adapt to various requirements, ensuring accuracy and compliance while streamlining the invoicing process.

Legal aspects of B2B ecommerce invoicing.

When it comes to B2B invoicing, there are some legal aspects to consider, such as adhering to tax regulations, protecting sensitive financial data, and complying with international invoicing standards. Failure to follow these guidelines can lead to penalties, legal disputes, and reputational damage. By staying informed and proactive, however, businesses can safeguard their operations and foster trustworthy client relationships.

How to pick the best B2B invoicing tool for your business

Now that you know what to expect when incorporating invoicing into your ecommerce business, let’s take a look at how to select the best B2B invoicing tool for your business. We’ll help you navigate key considerations such as budget, integration capabilities, and compliance to ensure you make an informed decision that’s tailored to your unique needs.

Consider your budget.

When selecting a B2B invoicing tool, it may be tempting to opt for the most affordable option. However, the cheapest option may lack essential features, resulting in inefficiencies and hidden costs down the line.

Instead, think about your invoicing tool as a long-term investment, considering factors such as time savings, error reduction, and improved cash flow down the line. Invest in a robust invoicing tool that gives you the best bang for your buck — balancing cost with functionality, scalability, and support.

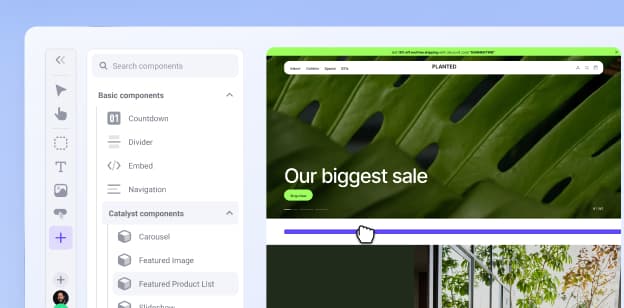

Prioritise ease of use.

The last thing you want is for your system to detract from your core business activities. Especially if you’re a small business owner with tight resources, you’ll want to ensure that your invoicing platform is user-friendly, easy to set up, and requires low maintenance.

Look for intuitive interfaces, clear instructions, and around-the-clock customer support. A straightforward tool will not only reduce the learning curve for your team, but also ensure smooth, efficient invoicing processes, allowing you to focus on what’s important: growing your business.

Integrate seamlessly with your tech stack.

As mentioned, your invoicing tool needs to be a well-oiled machine with the rest of your tech stack. Seamless integration will eliminate the need for manual data entry, reduce human errors, and ensure real-time updates across your business operations.

Scalability matters.

If you’re a B2B ecommerce business, chances are you’re looking to scale.

That said, you’ll need an invoicing platform that can grow and adapt with your business. Look for solutions that offer flexible features, accommodate increased transaction volumes, and support additional users without compromising performance.

Look for customer reviews and testimonials.

Just like choosing any other business platform or tool, credibility is key.

Look for customer reviews and testimonials that provide real-world insights into the platform’s performance, reliability, and customer support. In addition to traditional review sites, LinkedIn can be a useful resource for finding industry professionals who have experience with the invoicing tool. Keep an eye out for any potential issues or red flags, and gauge user experiences to make an informed decision.

Ensure compliance and security.

Like other ecommerce platforms, your invoicing solution must adhere to regulatory standards, such as tax laws and data protection regulations, to avoid legal issues and penalties. That said, make sure to look for tools that offer robust encryption, secure data storage, and compliance with international standards like GDPR.

Freedom to customise.

Not one of your B2B clients is the same — and neither are their invoices. Each one of your B2B customers will likely require a unique set of custom fields, branding elements, and personalised payment terms, which means your invoicing solution needs to have ample customisation options. Choose a tool that not only allows you to reflect your own brand, but also offers a variety of invoicing templates that cater to the distinct needs of your clients.

Key features to look for in B2B ecommerce invoicing tools

With several B2B invoicing tools on the market, it’s important to know what key features and functionality to look out for. Here we’ll outline a few considerations before committing to an ecommerce invoicing solution.

Automation capabilities.

No longer does invoicing have to require manual data entry and repetitive processes. Many e-invoicing tools now allow users to automate routine tasks like invoice generation, payment reminders, and reconciliation, thus reducing manual effort, minimising errors, and accelerating cash flow.

Multi-currency support.

If you’re a global business or are looking to expand into international markets, multi-currency support is a must. Look for invoicing solutions that can handle multiple currencies and allow you to easily transact with international clients, providing accurate currency conversions and accommodating various payment preferences.

Tax calculation and compliance.

At the end of the calendar year, you’ll need to be able to quickly tally up how much income your business made for the year, as well as how much you’ll owe in taxes, including VAT, GST, and sales tax. Luckily, many invoicing tools provide accurate tax calculations and automated compliance features to help you streamline that process, ensuring that your business stays up-to-date with changing tax laws.

Real-time reporting and analytics.

One of the major perks of having an e-invoicing solution is that you can often leverage real-time reporting and data analytics. Using these features, you’ll be able to gain insights into your financial health, tracking invoice statuses, receivables, and cash flow in real-time. This way, you can make informed decisions, identify potential issues before they escalate, and optimise your invoicing processes for greater efficiency.

Payment terms and conditions management.

Make sure your invoicing tool provides the ability to set, customise, and enforce payment terms — such as due dates, early payment discounts, and late fees. Not only does this ensure transparency with customers about your business’s policies, but it can also encourage timely payments and improve cash flow.

Payment gateway integration.

To make the payment process as smooth as possible for clients and suppliers, your invoicing tool needs to be able to seamlessly integrate with various payment gateways. Just like B2C customers, B2B buyers want to be able to pay the way they choose.

By offering multiple payment options and automating payment processing, you can streamline procurement and supply chain processes, enhancing efficiency and improving the overall customer experience.

Customer support.

Chances are, at some point, you could run into issues with your invoicing tool. So make sure you’re choosing a solution that offers prompt customer support, whether it's troubleshooting technical problems, providing setup assistance, or offering guidance on advanced features.

The final word

With Millennials and Gen-Zers making up 64% of today’s business buyers, it should come as no surprise that the B2B landscape is evolving. These generations, which have grown up in the digital age, are spearheading the shift toward a new kind of B2B buying process — and that includes the digitization of B2B invoicing.

By adopting a thoughtful approach to online invoicing, you'll be able to streamline operations, improve cash flow, and set your business up for long-term success in the modern B2B space.

Explore BigCommerce’s B2B Edition to learn how you can enable diverse payment methods for faster, more efficient transactions, accelerating invoicing and payment processing.

Yes, many B2B invoicing tools can integrate with CRM and ERP systems. With BigCommerce, for example, businesses can simplify vital integrations with one-click or customise your automation with open APIs. These integrations can help reduce manual data entry, minimise errors, and provide a unified view of business operations, leading to more efficient and accurate invoicing processes.

Yes, it is possible to set dynamic pricing with many B2B ecommerce invoicing tools. BigCommerce, for example, allows you to offer personalised pricing options, quotes, and discounts to foster customer loyalty, increase sales, and improve satisfaction. Also, you can dictate custom pricing and catalogues for individual customers or customer groups, located behind individual logins.

By adopting a transparent and professional approach, B2B ecommerce businesses can handle outstanding payments in a way that not only solves the issue but also strengthens the client relationship. Here are a few tactics:

Set clear payment terms upfront.

Use automated reminders to prompt timely payments.

Offer flexible payment options to accommodate customer needs.

Implement reasonable late fees as an incentive.

Offer payment plans for larger invoices or clients facing financial difficulties.