Attract the Modern Home Furnishings Shopper with Insights from our Latest Consumer Report

Attract the Modern Home Furnishings Shopper with Insights from our Latest Consumer Report

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

Today’s home furnishings brands face a variety of challenges, from inflation to shifting consumer behaviors. To help these businesses attract shoppers and strategically scale amidst these obstacles, we conducted a survey of over 3,000 consumers who have purchased home goods in the past 12 months.

We’re excited to announce the release of our Omnichannel Customer Journey Report: The New Buyer Experience for Home Furnishings Shoppers, which provides data-driven insights to empower home furnishings brands. This report reveals what motivates shoppers to purchase home goods in today’s economic climate and offers actionable strategies to help brands attract and retain customers more effectively.

Get a sneak peek of what’s inside this data-packed resource.

Supercharge your growth with an omnichannel strategy

With the recovery of in-store shopping post-pandemic, a strong omnichannel strategy is crucial. Consumer preferences for in-store vs online shopping are more diverse than ever before, with 48% of shoppers preferring to purchase home furnishings in-store, 28% favoring online shopping, and 24% having no preference.

This means it’s essential for brands to leverage multiple selling and advertising channels to cater to every type of shopper — from product discovery to purchase. To maximize visibility, home furnishings brands should invest in building a strong social media presence. Additionally, listing products on big-box store websites and online marketplaces is crucial to reaching consumers wherever they shop.

Beyond tapping into various touchpoints, offering Buy Online, Pick Up in Store (BOPIS) is vital for seamlessly blending the online and offline shopping experience. This feature gives consumers the best of both worlds and often leads to additional in-store purchases when they pick up their orders.

Break consumer habits with strategic promotions

Whether someone is a die-hard in-store shopper or an avid online buyer, a compelling promotion can often sway them to switch their preferred purchasing method. In fact, 82% of shoppers who prefer in-store purchases will likely buy online when an online-only promotion is offered. Similarly, 76% of those who favor online shopping will likely purchase at a physical store if presented with an in-store-only promotion. To maximize engagement, home furnishings brands should offer incentives like percentage discounts, BOGO deals, or free gifts with purchase.

To effectively communicate these promotions, brands should diversify the channels they use. While email remains the preferred method for most consumers, it’s equally important to invest in personalized promotions through other mediums, such as text messaging, as these subscribers tend to be more engaged.

Balance sustainability and affordability

Today’s consumers want sustainable home goods, but most are unwilling to pay more than 10% extra for eco-conscious products. To meet these preferences, home furnishings brands should explore cost-effective ways to integrate sustainability into their business. By promoting their green initiatives, brands can build stronger relationships with consumers who prioritize eco-friendly practices.

Future-proof with the latest technologies

With technologies like AI, AR, and VR steadily integrating into the shopping experience, brands have a unique opportunity to harness these tools to optimize their businesses. Although the majority of consumers have yet to use these technologies to aid their purchase decisions, 47% of those who have reported feeling more confident in their choices.

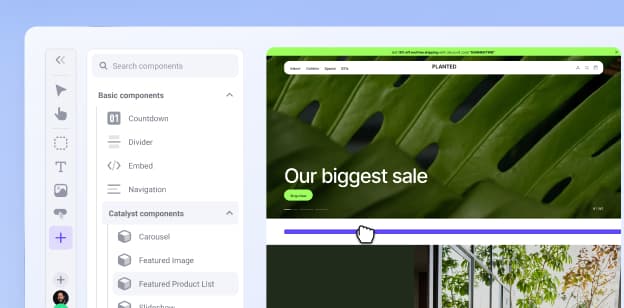

As consumer preferences evolve, it won’t be long before they expect businesses to offer these technologies. Brands can get ahead by exploring how to incorporate them into their online stores.

Create comfort with Buy Now, Pay Later

Given today’s economic climate, many consumers choose to save rather than spend on home furnishings. A survey by McKinsey & Company found that throughout the summer, shoppers prioritized essential items over discretionary products like furniture, reflecting a more cautious approach to spending.

To alleviate purchase anxiety, brands should offer flexible payment options like Buy Now, Pay Later. In fact, more than two-thirds of consumers expect home furnishings brands to provide this payment option.

With 20% of shoppers unwilling to purchase without BNPL, it’s more important than ever for brands to integrate payment tools like Afterpay, Affirm, and Klarna. Flexible payment options not only give customers the comfort to make purchases but also help increase sales and foster brand loyalty.

Boost consumer confidence by simplifying returns

A solid return policy is essential to help consumers feel comfortable purchasing home goods online. In fact, 60% of shoppers are more likely to buy from an online store that offers free return shipping.

To provide consumers with the confidence they need to shop online, brands should prioritize simplifying the return process. This could include features like free pick-up services or packageless drop-off at convenient locations.

By making returns easier, brands can boost consumer confidence and increase online sales.

Start Growing with BigCommerce

Check out our Home and Garden Solutions page to see how you can take your business to the next level with BigCommerce.

The final word

With home furnishings brands facing a variety of challenges, understanding shopper preferences and implementing strategies that meet their needs is more crucial than ever.

By offering a seamless shopping experience across multiple touchpoints, blending online and offline interactions, and adapting to evolving consumer demands, home furnishings brands can boost sales and stay resilient in today’s economic climate.

Download our Omnichannel Customer Journey Report: The New Buyer Experience for Home Furnishings Shoppers to learn how to elevate your business.

Annie is a Content Marketing Writer at BigCommerce, where she uses her writing and research experience to create compelling content that educates ecommerce retailers. Before joining BigCommerce, Annie developed her skills in marketing and communications by working with clients across various industries, ranging from government to staffing and recruiting. When she’s not working, you can find Annie on a yoga mat, with a paintbrush in her hand, or trying out a new local restaurant.