Key Signs It’s Time to Consider a New Tax Management Strategy

Key Signs It’s Time to Consider a New Tax Management Strategy

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

An increase in the complexity of tax regulations and more scrutiny from tax authorities has made some companies recognize that their current tax management strategy may no longer be enough to meet their business needs.

What was once seen as a mere compliance necessity is now regarded as a powerful catalyst for driving efficiency, profitability, and sustainable growth.

Let’s explore five tell-tale signs that suggest it may be time to reassess your tax management strategy.

Increasing sales volume

The more transactions your business has, the more time-consuming and error-prone managing tax is likely to become as those transactions can trigger nexus. Once triggered, you are required to register, collect, and remit tax in those jurisdictions.

To optimize costs, it’s important to ensure that your tax management strategy is based on a fixed rate rather than the number of transactions your business incurs, especially when dealing with a larger sales volume.

Growing product lines

Every product your business sells has a tax code. The more products/SKUs you introduce, the higher the likelihood is that you will have more tax codes to keep track of.

Your current tax management strategy needs to include your products’ detailed description, image, ingredients, and any other data that might impact taxability so it can make the best determination possible.

New market expansion

The more states, regions, and/or countries you sell into, the higher the likelihood of nexus, which means you must register, file, and remit tax for each of those jurisdictions.

Once expanded outside of the U.S., your business will need to adhere to specific VAT rules.

To remain compliant, your current tax management strategy must stay on top of cross-border compliance through tax registration, tax determination, invoicing, filing, and remittance. This also includes being able to account for different currencies, which impacts accuracy.

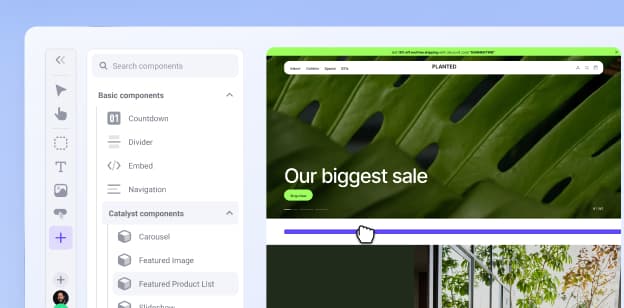

Broadening sales channels and systems

Similar to new market expansion, once your business extends into new sales channels, it may also establish a physical presence or economic nexus in additional jurisdictions.

To provide a unified, consistent customer experience, your current tax management strategy must be able to manage a single transaction that spans multiple channels — BOPIS (Buy Online, Pick Up In Store), BORIS (Buy Online, Return In Store), curbside pickup — and systems such as your POS, ERP, CRM, etc.

Plus, it should be able to account for tax rate changes that occur between the purchase date and the return date.

Company mergers or acquisitions

Acquiring a new company means you take on everything about that business. Therefore, everything previously mentioned — how much that company sells, what they sell, where they sell, and through what channels and systems they sell — now affect your business as well.

These business changes can result in new tax requirements that you must account for in addition to that of our own business. It’s important to have a tax management strategy that can adjust and easily integrate with your current setup.

The final word

By proactively addressing these signs and reevaluating your tax management strategy, your business can not only achieve compliance but also optimize your tax processes to drive profitability, enhance operational efficiency, and spearhead long-term growth.

While there are several tax management providers available, Vertex often emerges as the provider of choice for expanding businesses due to their unmatched global capabilities and expertise and proven track record of supporting enterprises.

Learn more about Vertex — and their integrations with BigCommerce — today.

Pablo Gallaga is a Senior Manager of Content Marketing at BigCommerce where he focuses on thought leadership content. His years of experience in tech, from startups to enterprise, inform his ecommerce insights.