Watch Our Product Tour

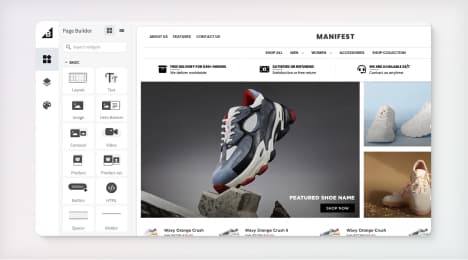

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What is a tariff?

A tariff is a tax or levy imposed on goods exported from one country to another. They are essentially used to drive sales of products created domestically. Rather than pushing people to buy goods from abroad.

How Do Tariffs Work?

Tariffs are put in place to restrict imports from other countries. The price to import goods from other nations is increased so that it puts people off buying from abroad. The idea is that people will buy products from inside the country, and this will drive the economy.

Bear in mind that tariffs apply to goods and not services. So, a tariff would be applied to a car coming from Germany to the USA. But not to a company selling a TCPA dialer as a service.

There are two different types of tariffs that can be imposed. The first is to implement a fixed fee on an item. For example, $100 on a television. The type of tariff is to add an ad-valorem worked out from the item's value. E.g., 10% of the television’s cost.

Who Imposes Tariffs?

Governments make decisions about tariffs and impose them. They do it to create customer loyalty within their own countries. It's also to protect domestic industry and jobs. In making foreign goods more expensive, it persuades people to buy domestically. Rather than pumping money into different economies.

For example, say a person wants to buy a bag of apples. The price of a bag of apples grown in their own country may be $1. Due to import tariffs, a company may not be able to charge any less than $1.30 for a comparable bag of apples grown and imported from abroad.

As a result, more people will want to buy the cheaper apples grown in their own country. The aim is that more money will go towards the farmers, pickers, and packers in that country.

This also dissuades people from moving abroad to look for work. Say, for example, a parent company that sells goods is interested in setting up a call center. If it is making more money domestically, then it can pay its staff higher wages. That means it won’t have to outsource work to a company abroad with cheaper costs.

This, in theory, means that more money is flowing through the economy on a domestic level. And customers can contact companies in the same country, too.

Often, tariffs are used as an extension of foreign policy. It’s a way to gain economic leverage on a trading partner’s main exports.

Are There Downsides to Tariffs?

There are some negatives to imposing tariffs. One problem is that less competition drives prices up. Leaving certain goods unaffordable for consumers.

What’s more, certain industries experience tariffs while others don’t. So, tension is created between sectors. For example, a voice over IP service being sold from the USA to Mexico wouldn’t have a tariff imposed. However, if a company exported furniture from the USA to Mexico, that may have a tariff imposed.

As well as this, different regions may also end up being favored over others. This is because each country sets the tariff, and the importer has to pay the tariff. Say, a person wants to sell t-shirts from Zimbabwe. They may be charged a different tariff in France than they are in China.

However, importers will often pass these tariff prices onto consumers. Making it hard for some people to afford otherwise cheap products from other countries.

It also affects people domestically. For example, a tariff that helps people with manufacturing in the city may not help people that produce food in the country.

What’s more, tariffs can decrease the range of products available in a country. A nation that produces small amounts of goods domestically may rely heavily on imports. However, putting tariffs on certain products can reduce the affordability of goods that wouldn't otherwise be available.

Conclusion

Tariffs have both positive and negative points. The point of imposing them is to persuade people to buy more domestically, to feed their own economy. Protecting certain sectors and jobs as a result.

Yet, a negative is that it reduces the affordability of certain goods coming from abroad. And, not everything coming from a different country will have a tariff. So, an orange moving from Spain to Scotland will do. But a paid service like screen sharing software won’t.

Producers are handed the bill for tariffs, yet it is often consumers who end up footing it. So, unless you are solely buying domestically, tariffs will have an impact on your life in one way or another. Of course, as the world alters politically, tariffs will keep on changing, too.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo