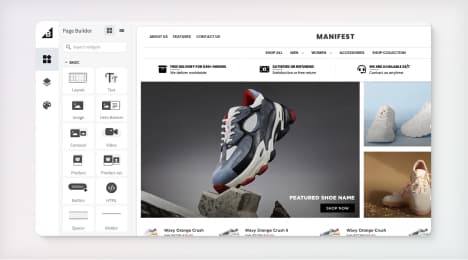

Watch Our Product Tour

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What Is Ecommerce Sales Tax?

The internet is a competitive space for businesses. In addition to luck, you need a can-do attitude, good products, and an excellent online sales platform to succeed.

Equally important is an understanding of ecommerce sales tax obligations. Failure to collect and remit as required can lead to negative audit findings along with crippling penalties and interest. Getting sales tax right from day one is a much better way to go.

Ecommerce Sales Tax Defined

The term “online sales tax” or “ecommerce sales tax” suggests there’s a special tax for online sales. In fact, online transactions are like other sales: Some are subject to sales tax in some states; some are not.

Whether you need to collect sales tax on an online transaction hinges on a variety of factors, including the location of the sale and the product or service being sold. For companies selling across state lines, it also depends on nexus.

Simply put, nexus is a connection between a business and a taxing authority, such as a state. When a business has nexus with a state, it must register with the tax department, collect and remit sales tax, and file returns. States cannot impose a sales tax collection obligation on a business that doesn’t have nexus.

It’s up to each business to determine if nexus has been established. But you can be sure that states are checking to ensure businesses are registered and collecting as required by law.

When You are Obligated to Collect Sales Tax

Amazon founder and CEO Jeff Bezos made his first online book sale in 1994, when sales tax nexus was based primarily on physical presence. A state could require a business with a physical connection to the state to collect and remit sales tax, but it couldn’t place that obligation on a business with no physical presence in the state.

Physical presence includes what you’d think: a brick-and-mortar store, office, or warehouse. Yet it can also be a remote employee, inventory in the state, or a relationship with an in-state affiliate. Attending a trade show can establish nexus, as can delivering merchandise in a company-owned vehicle, or contracting with a person to install, maintain, or repair the products you sell. In short, a physical presence isn’t always as obvious as it seems.

Yet at its core, it’s still tied to a physical connection. Ecommerce pioneers were keenly aware of the advantage of selling into states where they had no physical presence when they transformed the world of retail. It served them well for more than twenty years, until the Supreme Court of the United States overruled the physical presence rule in South Dakota v. Wayfair, Inc. (June 21, 2018).

The court found the physical presence rule to be “unsound and incorrect”: Businesses could establish sufficient nexus through their “economic and virtual contacts” with a state. Thus, although having a physical presence in a state still establishes nexus, a sales tax collection obligation can now be based solely on a remote seller’s economic activity in the state. This is economic nexus.

Economic nexus is currently enforced in 43 states, the District of Columbia, and parts of Alaska (where there’s local sales tax but no statewide sales tax). Indeed, Florida and Missouri are the only two states that have a general sales tax but haven’t adopted economic nexus — and they’ll likely embrace it eventually. Economic nexus has completely transformed the retail landscape, especially for companies that sell online into multiple states.

Unfortunately, the legacy of the physical presence rule lives on as a decoy: It gives a false sense of security to businesses that haven’t heard of Wayfair, or those that believe states can’t or won’t enforce economic nexus.

To succeed in ecommerce today, it’s essential to understand economic nexus — and its potential impact on your business.

6 Steps to Ecommerce Sales Tax Compliance

If you’ve been selling online for years and have an established customer base across multiple states, there’s a good chance you’ve already created economic nexus in one or more states. If you’re relatively new to ecommerce and are still seeking a foothold in your market, you may not have. Either way, it’s important to know what it takes to be sales tax compliant in all states where you sell.

1. Determine where you have sales tax nexus.

For the most part, economic nexus laws are based on a remote seller’s sales or transaction volume during a specific period — typically the current or previous calendar year. Most states provide an exception for small sellers, but what constitutes a small seller varies from state to state.

In California, for example, economic nexus is triggered when a remote seller (and all persons related to the retailer) has more than $500,000 in combined sales of tangible personal property for delivery into the state in the current or preceding calendar year. By contrast, the economic nexus threshold for Colorado is more than $100,000 of retail sales or taxable services in the state. And in New York, the threshold is $500,000 and 100 transactions.

Kansas is the outlier here; in theory, one sale worth $1 could trigger economic nexus in the Sunflower State.

For state-specific economic nexus details, see this state-by-state guide to economic nexus laws.

2. Verify if your products are subject to sales tax.

Knowing whether what you sell is taxable or nontaxable in a state is essential to determine where you have economic nexus, as some states exclude exempt transactions from the economic nexus threshold. Furthermore, if you only make exempt sales into a state, you won’t be responsible for collecting and remitting sales tax in that state.

Taxability laws vary, of course. All shirts are exempt in New Hampshire, where there’s no sales tax, and taxable in California, where there is. Any shirt is taxable in Massachusetts if it costs more than $175. In New York, a shirt priced $111 or higher is subject to state and local sales tax no matter where the sale occurs, while a shirt with a sales price of less than $110 is exempt from state sales tax, but subject to local sales tax in Albany County and Yonkers.

This makes perfect sense to lawmakers and tax authorities, who are trying to balance the needs of state and local governments. But frankly, it can be crazy-making for businesses.

Furthermore, businesses that make only exempt sales into a state aren’t necessarily off the hook for sales tax. Many states require remote sellers of exempt goods or services to register with the tax department, document exempt sales, and file returns.

3. Get legal by registering for a sales tax permit.

Once you’ve determined you have nexus with a state, you need to register with the tax authority and obtain a sales tax permit (also known as a seller’s permit). This must be done before collecting sales tax from anyone in the state.

Fees for sales tax permits range from $0 (e.g., California and New York), to $16 (Colorado), and $100 (Connecticut). Some sales tax permits need to be renewed every year or two; others will last for as long as you have your business. Tax authorities always need to be alerted if you change your contact information or any other aspect of your business, such as what you sell or who you sell it to.

In some states, it’s necessary for remote sellers to obtain a sales tax permit as soon as the economic nexus threshold is crossed (i.e., before the next sales transaction). Other states allow more time. Thus, it’s important to track your sales into each state closely and know what’s expected of you. If you should be registered and collecting sales tax, but aren’t, you may be liable for the uncollected sales tax.

4. Set up sales tax collection on your online shopping carts and marketplaces.

Everything about sales tax is organic: Sales tax rates, rules, and regulations are subject to change from coast to coast. Furthermore, your nexus footprint will likely change as your sales increase and states amend their remote sales tax laws.

Furthermore, businesses that sell primarily through marketplaces may find sales tax is largely handled by the sales facilitator (aka, marketplace): A growing number of states now require marketplace facilitators to collect and remit sales tax on behalf of third-party sellers.

Yet even here, there can be hidden traps for ecommerce businesses. For starters, some states require marketplace sellers to register and file returns even if they’re not responsible for collecting and remitting sales tax. And direct sales are always the domain of ecommerce sellers, even those that sell through multiple platforms.

Managing sales tax manually is error-prone and will quickly consume your days. A cloud-based sales tax solution that integrates with your shopping cart helps ensure you collect the sales tax that’s due, and only the tax that’s due. Choose one that calculates sales tax on taxable transactions in real time, relying on product taxability rules and geolocation to determine rates: It will provide peace of mind.

5. Report how much sales tax you collected.

Sales tax revenue funds a variety of state and local services, including education, fire and police services, and transportation projects. For the dollars to get where they need to go, sales tax must be properly reported.

In most states, the state department of revenue collects all sales tax revenue and distributes the local portion to local jurisdictions as necessary. For that to happen, each sale must be assigned the proper location code; e.g., a sale occurring in San Francisco must be reported as a sale in San Francisco.

In states that allow localities to administer their own sales tax, such as Alabama and Colorado, local sales tax may need to be remitted and reported to individual local tax authorities. The state portion always goes to the state tax authority.

As far as reporting frequency goes, it’s generally determined by your sales volume. Companies that collect little in the way of sales tax may be able to report sales tax on an annual basis, or even quarterly. Businesses with a high-volume of sales typically report monthly and may even need to prepay a portion of the sales tax due. When in doubt, check with the state.

Even the most spreadsheet-loving person can find reporting sales tax to be a tedious task, especially if you file quarterly in one state and monthly in another. Automating sales tax reporting can streamline the process, enabling you to export data from multiple business systems to create reports on your transactions, liability, and exemptions.

6. File your sales tax returns.

To complete the sales tax cycle, you need to file sales tax returns and remit the tax you’ve collected and held in trust.

Though few people enjoy filing sales tax returns, brick-and-mortar stores that make sales in one jurisdiction only should be able to file returns manually without too much pain. Ecommerce businesses filing in multiple jurisdictions will likely find it more time- and cost-effective to automate the returns process. Once set up, it will save headaches and reduce audit exposure in the long run.

What's next?

If you’ve been holding off on a sales tax solution for your ecommerce store, it’s time to confront reality. States want and need tax revenue from online sales — some more than ever now that COVID-19 has crippled brick-and-mortar sales.

For now, most states are being understanding. They know many businesses are strapped for cash because of the pandemic and they’re waiving penalties and reducing or eliminating interest on late sales tax payments. It’s unlikely they’ll always be this forgiving.

Businesses that have nexus, whether due to economic or physical ties, are required to register with the tax authorities and comply with sales tax laws. At the end of the day, it’s as simple as that.

Find out where you likely have economic nexus with Avalara’s free sales tax risk assessment.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo