General press inquiries

pr@bigcommerce.comMon, 06/06/16, 10:00:00 PM

BigCommerce Survey Shows Americans Consider Online Shopping Essential

Online Shopping More Indispensable Than Smartphone GPS and Streaming TV and Music; Nearly One-third of U.S. Shoppers Buy Online Weekly

AUSTIN, Texas — June 6, 2016 — According to a new survey examining the online shopping and purchase habits of the U.S. population, results show that 96 percent of Americans are shopping online, spending an average of five hours per week making online purchases and allocating an average of 36% of their shopping budgets to ecommerce. U.S. shoppers ranked online shopping ahead of smartphone GPS and streaming media as a basic essential they could not live without, according to the report from ecommerce platform BigCommerce.

The study was conducted to determine how U.S. shoppers buy online, and to help inform and educate the broader industry on running an effective online business in today’s retail environment. Its results suggest that consumers are buying wherever, whenever and however is most convenient to their lifestyle and web browsing habits.

“Shoppers are dedicating more of their time and budget to online shopping, and the frequency and number of online stores they purchase from has grown exponentially during the past few years,” said Troy Cox, senior product director at BigCommerce. “With ecommerce now such a prevalent part of America’s buying habits, retailers have an incredible opportunity to reach more customers by opening their business to new channels.”

Who Shops Online

While ecommerce favors younger generations with millennials spending nearly half of their total budget online, all Americans are allocating a significant amount of their time and budget to online shopping.

67% of millennials and 56% of Gen X prefer to search and purchase on ecommerce sites rather than in-store; 41% of baby boomers and 28% of seniors prefer online to offline shopping.

Millennials and Gen X spend 50% more time shopping online each week (six hours) than their older counterparts (four hours).

Although they have greater proximity to physical stores, online shoppers in metropolitan areas spend more online annually ($853) than suburban shoppers ($768) or those in rural areas ($684).

Men reported spending 28% more online than women during the past year.

** Where the Money Goes**

Online spending is taking up larger portions of the American household budget, with shoppers going to marketplaces, online stores, major brands and specialty retailers to find the perfect product.

80% make online purchases at least once a month; 30% make a purchase at least once a week.

Nearly half (48%) of online shoppers have bought or spent more than planned when shopping online.

One in two (48%) online customer journeys begin at ecommerce marketplaces such as eBay or Amazon.

In the last year, online shoppers have spent the most with ecommerce marketplaces ($488), closely followed by major online/offline brands ($409) such as Nordstrom or Best Buy.

** Where & When They Shop**

With notifications the new normal and devices always on-hand, there is no limit to where and when people shop online.

43% of online shoppers have made a purchase while in bed.

A quarter of online shoppers (25%) have made an online purchase from a brick-and-mortar store.

23% have made an online purchase at the office, while 20% have purchased from the bathroom or while in the car.

One in ten shoppers admitted to buying something online after drinking alcohol.

** What Influences the Online Shopper**

Today’s online shopper is driven by price, shipping and a personal connection to the product.

When identifying factors influential in determining where to shop online, 87% of respondents cited price as influential, closely followed by 80% reporting shipping cost and speed as influential.

66% have decided not to buy an item because of shipping costs; 72% of females and 59% of males have decided to abandon their purchase because of shipping costs.

Online shoppers want products to be brought to life with images (78%) and product reviews (69%).

Half of respondents cite not being able to touch, feel or try a product (49%) as one of their least favorite aspects of online shopping; 34% said difficult to return items and waiting for delivery were also a pain.

** Shopping on Social Networks**

Consumers are more open than ever to buying via social posts and pins with 30% of online purchasers stating that they would make a purchase from a social media network.

Respondents were most open to making a purchase on Facebook (20%), closely followed by Pinterest (17%), Instagram (14%), Twitter (12%) and Snapchat (10%).

Males are more open (23%) than women (17%) to make a purchase through Facebook.

More than half (51%) of millennials say they would be likely to buy through a social network.

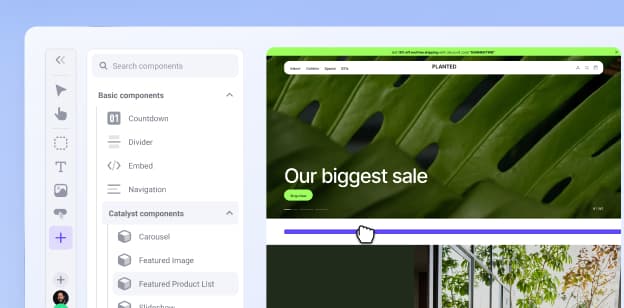

Potential and existing customers are discovering new products everywhere, and retailers should consider selling beyond traditional sales channels to grow their business. An advanced ecommerce platform like BigCommerce helps retailers power their online businesses through branded storefronts and sell across multiple channels, including Amazon, eBay, Facebook, eBay, Pinterest and Square.

About the Survey

BigCommerce conducted this survey in partnership with Kelton Global, a leading global insights firm, during March 15-19, 2016. Survey responses were collected from more than 1,000 nationally representative Americans 18 years and older who cited making an online purchase within the previous six months.

To view the full report on the country’s shopping habits, visit www.bigcommerce.com/articles/omnichannel-retail/.

###